How A Tax-Free Retirement Plan Restores Retirement Dreams

Will you be strapped for cash in retirement or will your retirement dreams be restored? Will you enjoy travel, leisure activities like golf, quality time with your grand children, and activities with your spouse?

The Tax-Free Retirement Plan can help make your retirement years special, helping you accumulate enough money to provide income for 30 to 40 years of retirement.

The Tax-Free Retirement Plan eliminates 3 Wealth Killers: Market losses, Taxes and Wall Street commissions, hidden fees and expenses.

Market losses are forever and compound just like gains. The money lost never works for you again. Remaining funds have to do double duty playing catch up as you dig out of an investment hole.

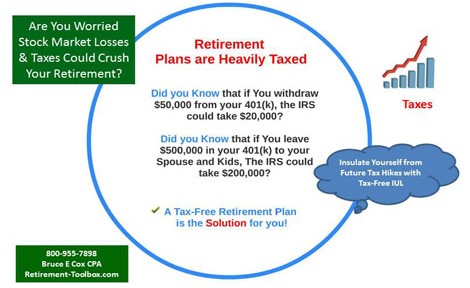

Taxes are another wealth killer. Did you know that if you withdraw $50,000 from your 401(K) the IRS could take $20,000? If you leave $500,000 to your spouse and kids in your 401(k) the IRS could take $200,000?

Your 401(k) is one of the most expensive ways to save for retirement. Wall Street Commissions, hidden fees and expenses can reduce your 401(k) balance by 33% over 30 years. In other words, after 30 years, your 401(k) balance would be 50% higher without these fees. This could cost you more than $500,000 over your working years.

Bottom line, you may only be a 40.2% partner in your 401(K)

33.0% to Wall Street

26.8 % to IRS (40% of 67%)

40.2% to you

The Perfect Retirement Solution, known as a Tax-Free Retirement Plan, a Tax-Free Pension Alternative, Living Benefit Life Insurance and a Tax-Free IUL eliminates the 3 Wealth Killers: Market losses, Taxes and Wall Street commissions, hidden fees and expenses.

It has been called the perfect solution because:

- You don’t lose money when the markets go down, so you are never digging out of an investment hole.

- You share in market upside when the markets go up, subject to an annual market cap rate, currently 13% to 16%.

- You’ll earn a reasonable rate of return.

- Gains are locked in annually, so you never give back profits previously earned.

- Withdrawals are tax-free penalty free at any age for any reason.

Tax-Free is better. Watch the short video and call us with comments and questions.

You can also request a free retirement plan comparison.